We use cookies to enhance your website experience. By using this website, you agree to our use of cookies.

Investor Help Centre

Every now and then questions arise. For a quick solution visit our Investor Help Centre or contact our Customer Service

General Information

Lendermarket connects investors to alternative assets offered by a range of carefully selected lending partners. We offer convenient and robust investment tools where individuals and institutional investors can grow their passive income at ease.

Creating an account is easy. Simply fill out the registration form available here. After registration is complete, you are required to verify your identity.

Both natural persons and companies can only have one investor account on Lendermarket.

We invite both individuals and companies to invest through Lendermarket platform. Individual investors are required to:

- – be at least 18 years old,

- – have a personal bank account in the European Economic Area or Switzerland,

- – and have their identity successfully verified by the Lendermarket team.

Family trusts, partnerships, limited liability companies, and other organizations must have a bank account in the EEA or Switzerland.

Please check the dropdown menu in the registration form to confirm if your country of residency and tax residency are included.

To verify the identity of the investor and before depositing funds, the investor shall be required to upload the following copies of identification documents:

Representative of the Company

– Evidence to show the authority of the representative to act on behalf of the company.

Company

– A copy / photo of Certificate of Incorporation and

– A copy of commercial register within the last 3 months confirming that the company remains registered on that registry’s register of Companies and / or is in good standing, registered office address, country of tax residence.

Ultimate Beneficial Owners of the company

– A copy of both sides of valid local identity card or copy of passport from all Ultimate Beneficial Owners.

Investing through Lendermarket is completely free of charge. Lendermarket does not charge any fees for opening an account, depositing or withdrawing funds.

The investor shall be fully responsible for paying all taxes arising from any repayments obtained as a result of its investment based on the legislation of the respective country. All repayments will be paid from Lendermarket to the investor’s bank account without any deduction or withholding for or on account of any tax.

Lendermarket does not provide any tax advisory services to the investors and we strongly suggest seeking professional tax advice.

Yes, as long as those bank accounts are under your own name. We confirm only active and verified bank accounts for each user of Lendermarket, the bank account used for the last deposit will become an investor’s default bank account.

It’s easy! You need to transfer at least 0.01 EUR from your new bank account to Lendermarket’s bank account for verification purposes.Your new bank account will be registered under your profile, then you will be able to deposit and withdraw funds to such account.

Please note that you can only switch to a bank account opened in a bank operating within the European Economic Area (EEA), UK or Switzerland.

You can now refer Lendermarket to your friends. For every successful referral done, we will reward both you and your friend with a 1% bonus of up to 1,000 EUR that will be calculated on your friend’s invested amount, within the first 30 days from your friend’s identity validation.

Find your referral link here. Lendermarket has also implemented an affiliate program in which investors can register through affiliate partners and obtain a cashback bonus. If you want to join the affiliate program please send an email to our support team at [email protected] to find out more.

Deposits

You can transfer money to your Lendermarket investor account from your personal or company bank account.

Transfers in EUR can be done easily and at low cost using SEPA (Single Euro Payments Area) transfer.

If your bank does not use SEPA transfers, your payment will be automatically rejected. We do not accept SWIFT transfers.

It is mandatory to add your reference number on the transaction in order for us to associate the deposit to your account.

We cannot accept deposits from shared (joint) bank accounts unless all bank account holders are registered and validated on our platform to comply with our KYC policies. The other bank account holder will be able to use their investor account if desired, however, they won’t be able to use the same bank joint account.

No, deposits are only accepted from the same bank account holder as the Lendermarket investor account.

No, the only possible means of payment at the moment is bank transfer. This is due to Anti Money Laundering legal requirements.

We only accept transfers in Euro.

The money transferred will be converted automatically according to the exchange rate of the respective bank or it will be returned to the sender. There may be some loss of funds due to the exchange rate or the bank fee for returning an incorrect payment.

Please inform us at [email protected] about the error as soon as you notice.

Withdrawals

You can make a Withdrawal from your Available Balance. However, Pending Payments represent your earned funds (interest and principal repayments) that have not reached your Available Balance yet. You can learn more about Pending Payments under Pending Payments.

Lendermarket has implemented a Pending Payments enhancement to provide further transparency to the status of your funds. Withdrawals requested before this implementation might take longer than usual. However, after the Pending Payments transition phase has concluded withdrawal requests are likely to be processed within 3 Business Days in most cases.

The processing timeframe of your withdrawal request is dependent on various factors, such as the time of your withdrawal request, national holidays and the bank receiving the funds. Please note Business Days excludes Saturday, Sunday and Public Holidays.

You can initiate a withdrawal through your investor account at any given time for the funds available on your account. Please bare in mind that you cannot withdraw funds that are invested in loans.

Importantly, you can only withdraw funds to the same bank account from which the first deposit was made.

Lendermarket imposes no charges for withdrawals. Nevertheless, your bank or money transfer service provider may charge additional fees for transfers. We suggest consulting your bank or money transfer service provider to get more information on any such fees.

In most cases, Lendermarket will process your withdrawal within 3 business days after your request. Additionally, payments can take 1 to 3 more business days depending on various factors, such as the time of your withdrawal request, national holidays, and the bank receiving the funds. This process is dependent on funds being received from Loan Originators. Receivables from Loan Originators are settled in batches where investments and repayments are offset against one another and the difference between the two is transferred. Due to this there can be instances where the new investments made are less than the amount of borrower repayments. In such instances, investor’s withdrawals become pending withdrawals while waiting for payment from the Loan Originator. Pending withdrawals are segregated from the platform’s own funds and are not related to the company’s liquidity.

Yes, it’s easy! You need to transfer at least 0.01 EUR from your new bank account to Lendermarket’s bank account for verification purposes. Your new bank account will be registered under your profile, then you will be able to deposit and withdraw funds to such account.

Please note that you can only switch to a bank account opened in a bank operating within the European Economic Area (EEA), UK or Switzerland.

Yes, the minimum amount for withdrawal is 50.00 €. Lendermarket does not charge any fees for withdrawals. If the account value is less than 50.00 €, investors can only withdraw the total amount of their account value.

Pending Payments

Your total Account Value consists of an Available Balance, Invested Funds and a Pending Payments amount. Pending Payments represent your earned interest and principal repayments that have not yet reached your Available Balance. At this stage, Lendermarket has received notice of an upcoming transfer but is waiting for the Loan Originator to transfer funds to Lendermarket. Once the funds arrive, your account will be credited thereby reducing your “Pending Payments” and increasing your “Available Balance”.

You will earn 18% interest (per annum) on Pending Payments if they remain pending after 10 calendar days (the “Grace Period”).

If in the event that an investor has a pending payment balance from a loan originator, the loan originator has 10 days to make the pending payment. During this 10 day period, no interest will accumulate. However, after 10 days, the investor’s Pending Payments balance will start to accumulate interest at a rate of 18% per annum.

Interest on an investor’s Pending Payment balance starts to be calculated after the 10th day, and it’s calculated using a simple formula:

Outstanding Amount x Pending Days x Daily Interest Rate of 18%.

Example:

Outstanding Amount: €100

Pending Days: 30

Interest (per annum) = 100 x (30-10[Grace Period]) x (0.18 / 360) = 1€.

Interest on an investor’s outstanding Pending Payment balance is transferred to the investor’s Available Balance after the Loan Originator’s settlement payment is received.

A Grace Period is commonly a set number of days after a due date during which payment may be made by the loan originator to investors without penalty. At Lendermarket, the Grace Period for Loan Originators to make settlement payments is 10 days. During this period, no interest is applied to Pending Payments.

No. Pending Payments reflect earned interest and repaid principal that has not yet been transferred from the Loan Originator to your account. Once the funds have been released to your Available Balance they can be withdrawn and they’ll be released usually within 3 Business Days.

Lendermarket will release Pending Payments to your Available Balance as soon as it receives funds (settlement payments) from Loan Originators. This process cannot be sped up by Investor Support as it is dependent on receipt of settlement payments from Loan Originators. You can monitor Pending Payments and your Available Balance on your account summary page.

Transfers of Settlement Payments are not instant. Timeframes can be influenced by the terms of the Loan Originator, Financial Institutions and market conditions. It is typical to observe an increase in Pending Payments during times of decreased demand caused by events such as the COVID-19 pandemic, the war in Ukraine, sanctions on Russia and economic downturn.

Interest on Pending Payments will be released together with any owed Interest or Principal Repayments as soon as Settlement Payments from Loan Originators are received.

Please refer to the FAQ topic “When can I expect my Pending Payments to be released?” for more information.

Investing

To start off with, you need to have transferred available funds in your account at Lendermarket to start making investments. You can start investing with as little as EUR 10,00. Simply browse the loan list and find the loans that meet your investment preferences. Alternatively, use our convenient Auto Invest function to optimize your efforts even more.

No, once you have already reviewed and confirmed your investment in the loan, the investment cannot be canceled.

The minimum investment in any loan on Lendermarket platform is EUR 10,00.

There is no maximum amount to be invested.

You can see all of the transactions in your account under “Account statement” page. Please, use the filters to see income earned from your investments at any given period. Alternatively, please navigate to “Summary” page for an overview of received payments.

All interest rates are calculated up until the repayment date and expressed as annual figures. Interest rates are calculated based on the following formula: Residual amount invested x Interest rate (%) / 360 x Period of investment.

Net annualized return (NAR) is an annualized measure of the rate of return on actual investments made in loans, after actual write-offs and service charges. NAR is not a forward-looking projection of performance. NAR is only calculated for the amount of money invested in loans. Please note that funds that are not invested in loans are not included in NAR calculations.

To calculate NAR, the methodology called XIRR (Extended Internal Rate of Return) is used. Extended Internal Rate of Return (XIRR) is a method to calculate returns from investments done at different periods. To calculate XIRR we apply Excel formula. XIRR formula in Excel is =XIRR (values, dates, [guess]). Values represent the transaction amounts, dates are the transaction dates and guess is the approximate return.

Interest rate shows the weighted average interest rate for all the investments you have made.

You can find the Tax Report download button on your Profile page, on the Tax Report section. Please, select the range you want your report to include and download as a PDF document.

Assuming the borrower pays according to the loan schedule and the repayment is done on time, the investors will receive the funds to their investor account on a day following the scheduled repayment date. The interest is calculated up until the repayment date.

Loan Originators provide Buyback Guarantees on Lendermarket’s platform. The Buyback Guarantee obligates the Loan Originator to repurchase loans more than 60 days past the due date. Due dates can change depending on the Loan Originator’s extension policy and the borrower’s circumstances. Each Loan Originator’s extension policy is accessible here under the heading “learn more”.

Creditstar’s extension policy allows up to 6 extensions (30 days each), a maximum of 180 extended days. In this scenario, the Buyback Guarantee kicks in from the 60th day after the extended days, bringing the maximum total number of late days to 240 (180 days extended + 60 days late).

If a loan is overdue but obtains an extension, the extension starts from the latest paid instalment, not from the day of extension. Depending on the duration of the extension and the loan’s repayment schedule – a late loan may become current again.

In 2022, very short-term loans (90 days or less) had the highest incidences of late days compared to longer-term loans.

When a loan is overdue, you continue accruing interest until the borrower pays back the loan or the Buyback Guarantee is activated. Buybacks are paid at the nominal value of the outstanding principal plus accrued interest. To date, all Loan Originators on Lendermarket have honoured their Buyback Guarantees.

The term “skin in the game” is commonly used in the finance industry. It refers to a situation when an owner(s) or principals of an investment vehicle maintain an equity stake in circumstances where outside investors are solicited to invest. This is to ensure the interests of the originator of the asset are aligned with the interests of the investor, as both sides have a stake in the investment.

All loan originators that place loans on Lendermarket are required to keep a certain percentage of each loan. For example, if a loan originator keeps 10% skin in the game, then 90% will be available for investors to invest in.

You can see the payment schedule for each loan under the section “Payment Schedule”.

Auto Invest

Lendermarket’s Auto Invest is a simple solution that offers you a way to optimise your efforts. You simply set the criteria for your money to be invested and each time a loan that meets the conditions is identified from the loan list, an investment is made automatically, saving you time, but keeping you in full control. You can also stop, cancel or amend your Auto Invest portfolio at any time.

Please check our blog articles to get more insights:

Your Auto Invest can be stopped by simply clicking the Stop button in your settings menu. Similarly, you can reactivate the Auto Invest by clicking the Activate button.

Once you have confirmed your investment criteria, Auto Invest will automatically review the loan list and starts investing in loans that meet your specific investment preferences. Whenever you amend your investment preferences, the loan list will be automatically reviewed again to find any new loans that would meet your investment criteria.

When Auto Invest is not investing, it is most often due to a lack of available loans corresponding to your specific investment preferences.

However, you can also check your settings, it could be that the limit of your Portfolio size has been reached or you haven’t enabled Reinvest feature.

You can set priority to your AI portfolios by dragging and dropping them up or down. The system selects the order according to these priorities.”

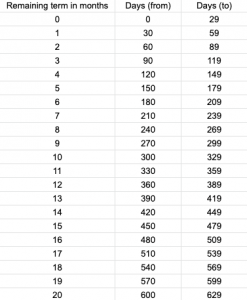

The remaining term filter works on a monthly basis, where one month has 30 days. Here’s an example of how many days are left in the loan, depending on what number you set. The maximum value here is 85 months.

Security

As with all investment opportunities, there are risks involved. Lendermarket has taken the following measures to mitigate the risk for investors, among others:

The security of your information and private data is a priority for us. Lendermarket deploys organized data storage following the highest security standards and legislation.

About Loans

For security reasons and to comply with data protection laws, we do not reveal any personal data of the borrowers.

In the event the borrower does not pay, the loan originator will pay you back the principal amount and accrued interest, thereby eliminating the risk of you losing your money.

When the borrower repays the loan before the scheduled term, your earned amount will be calculated according to the actual loan repayment date and transferred to your investor’s account.

Updated Platform Rules (from 2023 01 01)

The main reason for changes is to balance the rights and obligations between our Investors and Loan Originators. Changes are made in order to:

- Outline the two types of agreement models available (Limited Recourse Loan Agreement and Assignment Agreement);

- State the representations and warranties Loan Originators deliver regarding each listed loan;

- Increase the amount of information and documentation Lendermarket may request from its investors;

- Lendermarket having clear authorisations from Investors to better protect investor interests with the Loan Originator;

- Lendermarket having the right to request information from Loan Originators in order to inspect the underlying lending documents and better monitor their performance;

- Standardise terms with Loan Originators as Lendermarket no longer only services Loan Originators from Creditstar Group;

- Align the terms with the requirements from the Regulation (EU) 2020/1503 (the Crowdfunding Regulation).

The investment agreements are made between Investors and Loan Originators, whereas Lendermarket’s role is to service the contract. The two agreement models that Lendermarket operates under are Limited Recourse Loan Agreements and Assignment Agreements. These differing agreement models are needed to satisfy certain countries’ banking laws that some of our Loan Originators operate in. With the Assignment Agreement, Loan Originators assign the title and economic rights in the underlying loan receivables to Investors, whereas, the Limited Recourse Loan performs as a repayable loan instrument.

Lendermarket concludes Listing Agreement with Loan Originators. In the Listing Agreement, financial and other covenants are defined, and it regulates prerequisites for Loans to be listed on the Platform and under which circumstances the Loans shall be repurchased from Investors. Consequently, the agreement a Loan Originator is signing with Investors, may be different from the same model agreement made by another Loan Originator with Investors.

Representations are statements of facts by the Loan Originator related to each Listed Loan at a given time. Warranties are promises to indemnity if the assertion is false. In financing documents (such as loan agreements) representations and warranties are given by the borrower to induce the lenders to make loans. Once the loans are made, if a representation is no longer true, the lenders have the right to enforce their remedies against the borrower.

Lendermarket may request information or documentation pertaining to:

- Loan agreements and client file;

- Loan repayments;

- Financial Standing and Loan Book;

- Internal Rules, policies and procedures;

- Any other information Lendermarket deems necessary.

Lendermarket may request information or documentation pertaining to:

- Identity;

- Experience, education and knowledge relating to investment activity;

- Source of Funds;

- Level of Income;

- Purpose of becoming a user;

- Utility bills;

- Tax residency;

- Any other information Lendermarket deems necessary.

This additional information and documentation is required in order to maintain Know Your Customer (KYC) requirements as well as to sufficiently be able to monitor for Money Laundering or Terrorist Financing (ML/TF) activities. In addition, once regulated, we need to classify investors based on their knowledge and experience, and establish investment limits based on investor’s wealth.

Lendermarket may ask for this information and documentation upon the time of onboarding as well as any other time during the business relationship with the Investor.

Investors must provide updated details in the following instances:

All investors

- Change in Tax Residency;

- Change in Bank Account details;

- Change in PEP (Politically Exposed Person) status;

- Change in your Source of Funds;

- Change in your purpose of using the Platform.

Companies

- Insolvency Event;

- Change in BOs (Beneficial Owners);

- Change in your Investment Policy;

Lendermarket will deactivate AutoInvest on an Investor’s account:

- Upon the insolvency event of a user;

- Upon the notice of death of a user.

All Investors grant authorisations to Lendermarket to assure that each Investor with similar circumstances would be treated equally. On the other hand, the administration of tasks for which the authorisation is granted, is more efficient compared to each individual Investor contacting a Loan Originator. For example, related to each Participation, Lendermarket has the following authorisations on behalf of the user:

- Communication with the Loan Originator;

- Submitting and enforcing claims against the Loan Originator;

- Exercising any rights of the Lender;

- Enforcing the Buyback Agreement;

- Establishing and amending collateral rights.

Nothing is needed from you – by continuing to access the platform, you are agreeing to these rules.

Monitoring Loan Originators

The main purpose is to provide investors with additional information on the risk associated with each Loan Originator. We have redesigned our role in the transaction documents according to which we are entitled to monitor the fulfilment of contractual obligations by a Loan Originator. Lendermarket’s rights are described in the new rules of the platform (applicable as of 1.1.2023) but not all Loan Originators have yet implemented new versions of Limited Recourse Loan Agreements.

There are four categories: Transparency, Legal, Financial and Transactions. Assessment whether a Loan Originator is transparent is based on multiple factual tests: availability of public and financial information, presentation of ownership and management, adverse media etc. In the Legal category three aspects are monitored: registration and activities of a supervisory body, anti-money laundering procedures and compliance with certain rules and agreements. Financial monitoring includes tests related to the quality of underwriting policy (e.g., portfolio quality), meeting of financial covenants (e.g., interest coverage ratio), and audit of financial statements (e.g., recognised auditor, voluntary audit procedures). With the Transaction category a sample is selected representing Loan Originator’s agreements with investors and checks are carried out related to underlying loan agreement, disbursements to and repayments from the underlying borrower.

Each category has 9-15 different tests or factual checks. Based on the scoring methodology each of the four categories have different weights. The most important categories by weight are Transactions and Financial, followed by Legal and Transparency. The maximum score is 10, whereby the score of 1-4 represents higher risk, 5-7 is in the mid-risk range, and 8-10 is in the lower-risk range.

We have designed our monitoring procedures so that the testing exercises are mostly quarterly. However, we may update the score more frequently as certain covenants are monitored on a weekly or monthly basis (on a rolling basis).

Depending on the size, complexity, geographic location and other factors, we have applied an individual approach to Loan Originators. However, typical financial covenants are adjusted equity ratio, interest coverage ratio, Non-performing loans ratio. Certain other limitations may exist for a Loan Originator, like maximum allowed debt level compared to Loan Originator’s overall debt positions, or a requirement imposed on the Loan Originator for currency hedging.

In addition to the requirement to publish Loan Originator’s default ratio, we have the right to inspect the underlying loan portfolio of a Loan Originator. In such an exercise we verify that the underlying loan agreement has been duly concluded, the loan amount was disbursed prior to being listed on the platform, and whether the repayments have been received and reported.