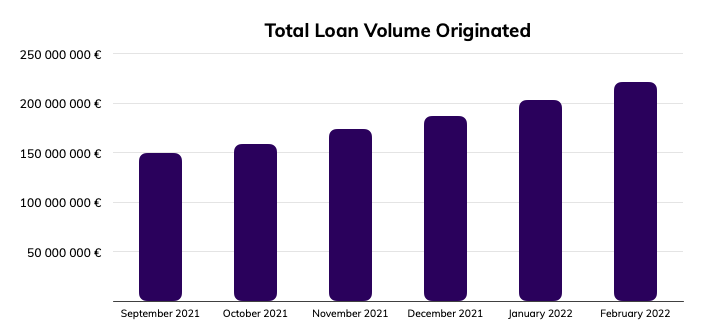

Total Loan Volume Originated shows the amount in euros that the loan originators made available to invest on Lendermarket. The graph below shows the cumulative loan volume originated in the last 6 months on the platform.

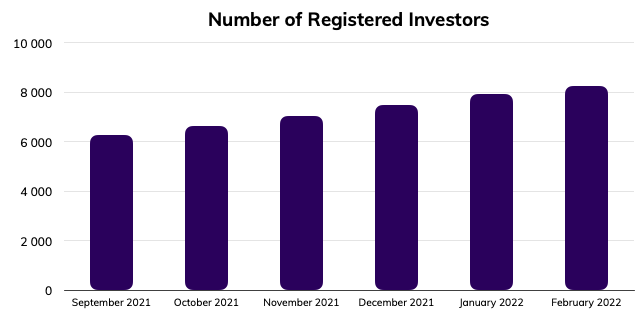

Number of investors* equal users that currently have funds in their investment accounts. The number of investors has been growing steadily month by month.

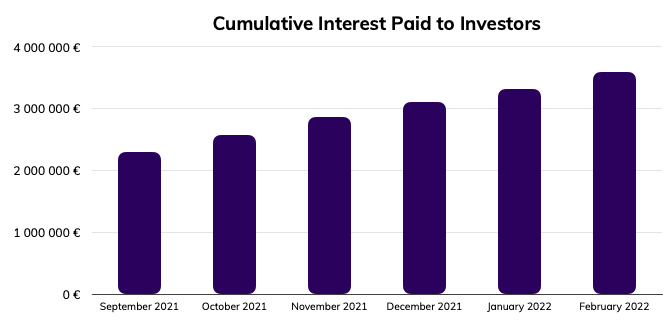

In the graph below we can see the amount of interest income earned by investors since Lendermarket started operations. The graph includes regular interest and delayed interest – interest received by investors when the loan is overdue.

Key Takeaways

We have helped our investors earn €268 982 in returns in February. We added 35 246 new loans to the platform last month. This means that our investors funded over €13 460 168 worth of loans last month, which is 112.38% more than the same time in February 2021.

*Starting from March, we’re updating Lendermarket’s reporting metrics to give our partners and the industry more clarity on our platform growth.

In the past, we have only reported the total number of users who had their funds already invested in loans. Going forward, we are adding a new data point to our monthly statistics and will start sharing the total number of customers who are engaged with Lendermarket, regardless of where they are in the conversion funnel. This additional data point will be combined with the ‘Active Investors’ statistics and reported as the ‘Cummulative number of Investors’.